Homemover Pulse - June 2022

Welcome to our June Homemover Pulse where we take the pulse of the UK property market and give a snapshot of current homemover activity.

UK Property Market Update - June

Whilst house prices have increased again in June, overall figures suggest that the housing market is still going strong. It’s inevitable that the rising costs of living and possible increased interest rates will impact the market in time, but at present the outlook is optimistic. Halifax has reported an all-time high for UK house prices, but this is the slowest growth rate so far this year which indicates that the market is beginning to cool.

Property supply is starting to improve somewhat, with new instructions creeping upwards in all regions of the UK. Completion figures have stabilised overall, whilst sales agreed have seen another increment in almost every region.

The Current State of the Owner-Occupied Property Market

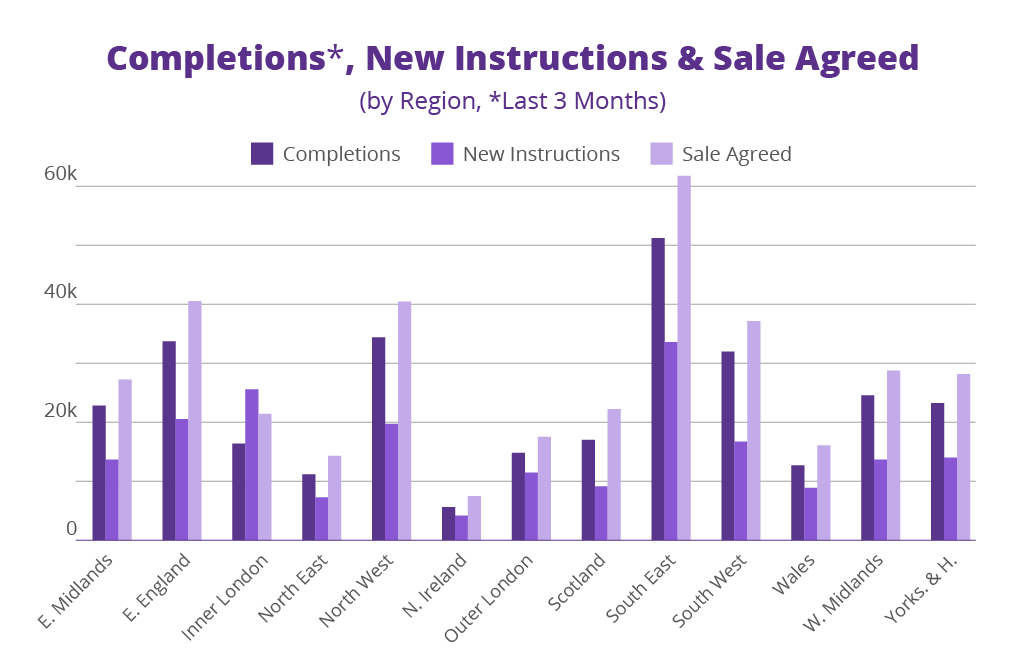

Currently, there are 197,466 residential properties available for sale and 361,605 properties with sales agreed across the country. There have also been 298,289 completions in the last three months. In the chart below, we have broken down these key stages of the home buying journey - new instructions, sales agreed and completions - by region of the UK.

The South East continues to take the lead with the highest number of new instructions, sales agreed and completions in the last three months.

Sales agreed in inner London have continued to rise faster than new instructions, and this trend continues to redress the balance in the area as the desire for London properties is renewed.

New instructions and sales agreed have continued to grow at a healthy rate, whilst completions have plateaued somewhat.

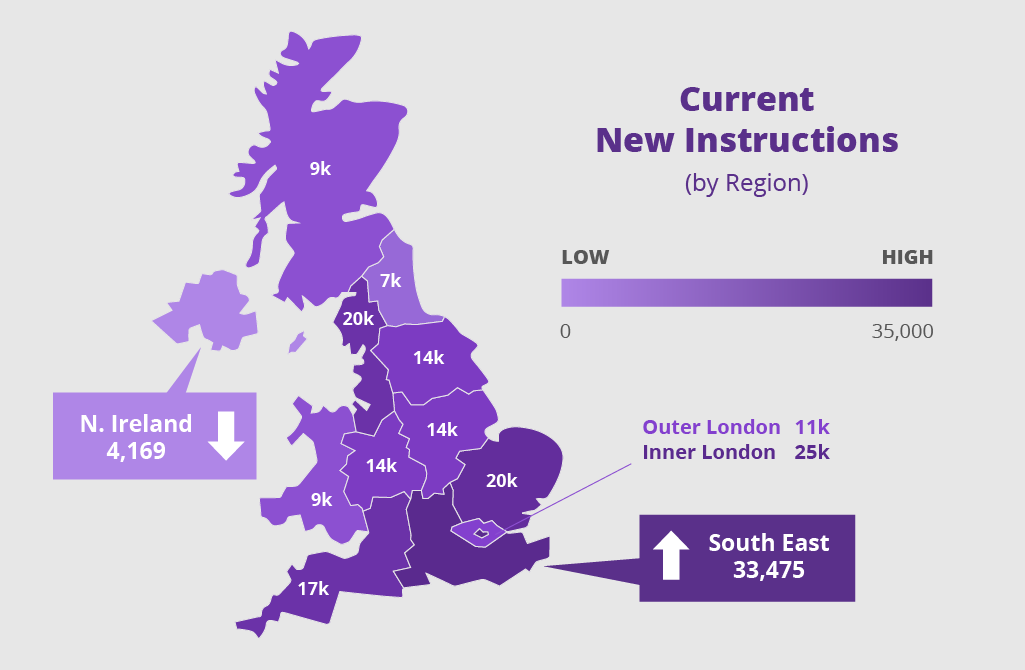

Current New Instructions

Our new instructions data covers all residential properties in the UK which are currently available for sale. There are currently 197,466 properties listed for sale across the UK.

Total new instructions have further increased, rising by 5.03% in comparison with last month’s total which is really positive to see.

As we have seen for a number of months now, the South East continues to have the highest number of houses currently available for sale, followed by Inner London and East England.

Once again, all UK regions have seen a month-on-month uptick in property supply, comparing May and June’s figures. In fact, every region has seen a minimum of a 2% increase in new instructions, which is something we haven’t seen in some time.

Whilst overall numbers are still the lowest at just 4,169 new instructions, Northern Ireland has seen the biggest increase in new instructions at 11.98%. This is shortly followed by Wales, with a 9.72% increase in new instructions month-on-month, and the South West which saw a 9% increase. The East Midlands is also still looking buoyant with an 8.36% increase.

At the other end of the scale, properties for sale in the West Midlands increased by just 2.83% and available properties in outer London increased by 2.03%.

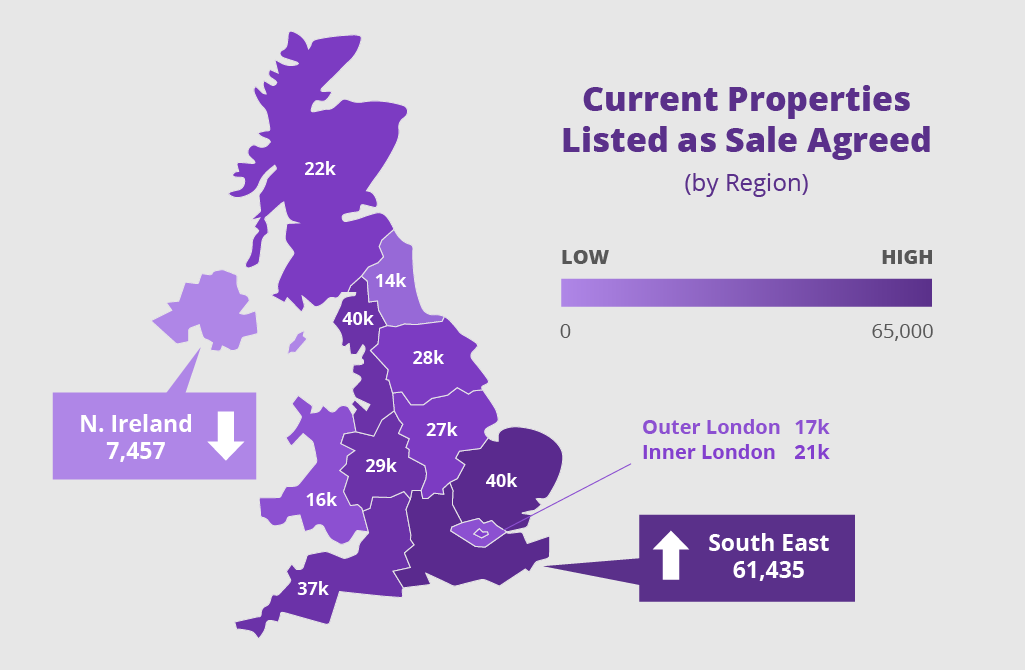

Current Properties With Sales Agreed

Our sales agreed data covers all properties in the UK which are currently at the start of the conveyancing journey and are sold subject to contract. Sale agreed figures can be seen as an indicator of present demand, showing where people are currently in the process of moving to. Currently, there are 361,605 properties across the UK with sales agreed.

Sales agreed increased 6.32% on May’s figures. If we look back to our March homemover pulse, when the total number of sales agreed was just 237,512, things have come a long way in the past 3 months. The rise from March to June is a whopping 52.25% increase in the total number of sales agreed across the UK.

The South East has by far the largest number of sales agreed at 61,453. As the largest region in the UK, this is not unexpected. However, this does continue to put pressure on the property supply in the region as new instructions aren’t increasing at the same rate. As we will come to see in the next section, completions in the region have seen a considerable decline, so it will be interesting to follow the progress of the region into next month.

Whilst sales agreed were soaring in Scotland last month, things have levelled off in the region this month. The South West has seen the largest increase in sales agreed at 8.70%, followed by the East of England at 8.53%, Inner London at 7.64% and Wales at 7.56%.

Despite the increase in properties available in Northern Ireland, this is the only UK region that has actually seen a month-on-month decline in sales agreed, decreasing by 2.07% in comparison with May.

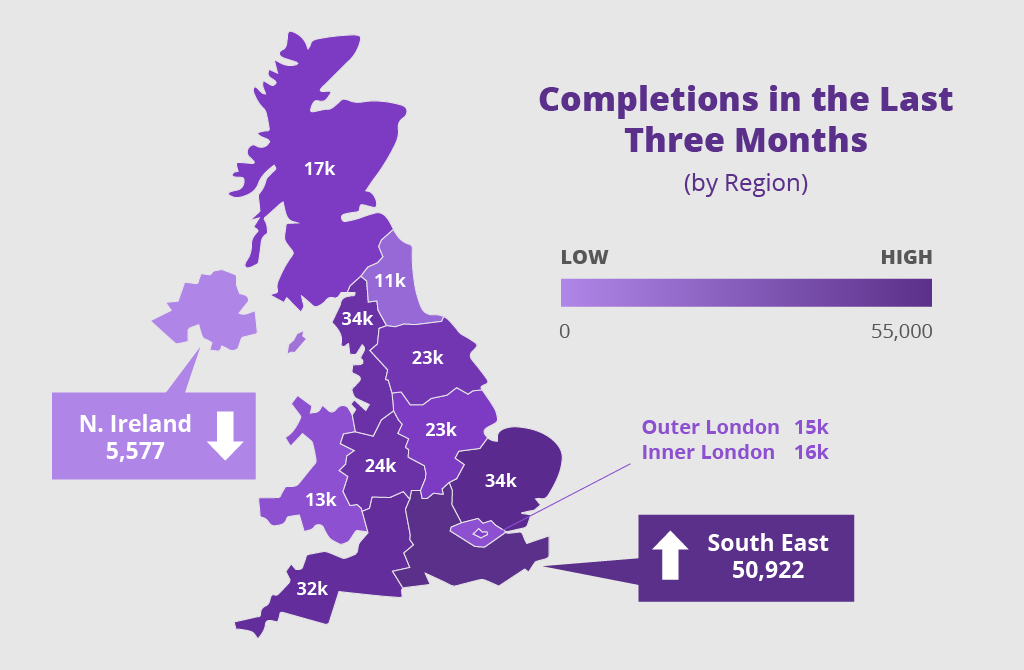

Completions in the Last Three Months

Our completions data covers all residential properties in the UK which have undergone contract completion in the last three months. This data set, therefore, covers all homes which have been newly purchased and moved into. In the three months to June, there have been 298,289 contract completions across the UK.

In June, completions have slowed somewhat, showing just 0.10% growth across the UK. Whilst many regions saw a small downturn in completions compared with May’s figures, there was an increase of 4.85% in the North West, 3.89% in the West Midlands and 3.17% in inner London.

The region which has seen the most completions in the last three months is the South East, recording 50,922 despite experiencing the most marked decrease of 3.66% in comparison with last month’s figures. The North West was looking buoyant with a total of 34,290 completions, improving on last month’s total.

The homemover audience represents a large opportunity for many businesses, from the retail sector to utilities and insurance. Homemovers spend an average of £42,000 on goods and services related to their move in the months before and after moving house. As property and homemover data experts, TwentyCi can help you tap into this large, high-value audience. Get in touch to find out more.