Homemover Pulse: UK Property Market May 2023

Welcome to our May 2023 Homemover Pulse where we take the pulse of the present UK property market and give a snapshot of current homemover activity.

With the UK’s largest and most sophisticated homemover database, we have unique access to house prices and residential property data at every stage in the purchase journey. Here’s the latest update on the UK’s housing market.

Property Market Summary May 2023

- New Instructions: 583,612

- Sold Subject to Contract: 381,152

- Completions in the last three months: 199,937

UK House Price Growth

The average house price for a property in the UK is £286,896. This is a 0.1% increase in the average price since last year.

According to the Halifax House Price Index, “The economy has proven to be resilient, with a robust labour market and consumer price inflation predicted to decelerate sharply in the coming months. Mortgage rates are now stabilising, and though they remain well above the average of recent years, this gives important certainty to would-be buyers. While the housing market as a whole remains subdued, the number of properties for sale is also slowly increasing, as sellers adapt to market conditions.”

The full report is available here.

The current state of the owner-occupied housing market: May 2023

583,612 properties are currently on the market across the UK. This is 3,993 less than highlighted in our April Pulse.

However, there were 6,872 more properties sold subject to contract than in April (381,152 compared to 374,280) and 2,692 more properties have been exchanged (199,937 compared to 197,245 in April).

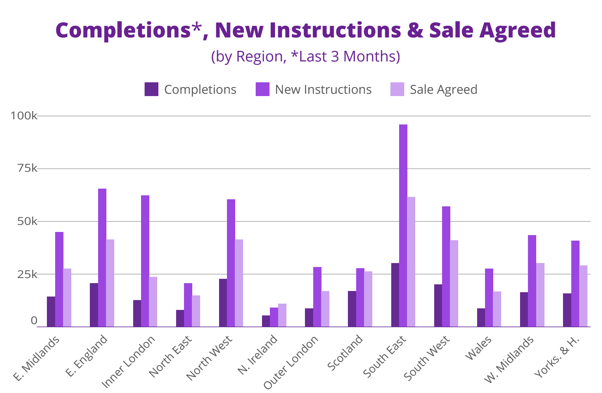

Below, the key stages of the home buying process have been broken down by stages and region.

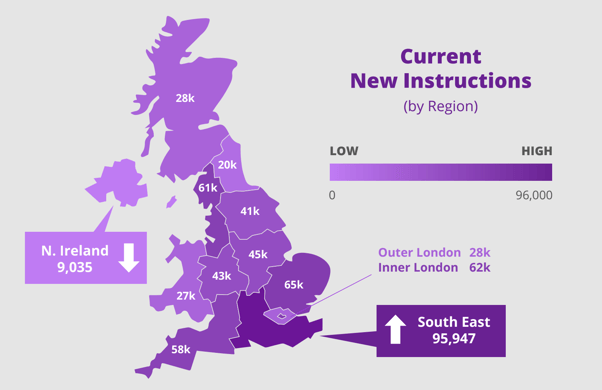

Current new instructions

Our new instructions data covers all residential properties in the UK that are currently available for sale. At the time of publication, there were 583,612 residential properties available for sale across the UK.

In April 2023, the South East had the highest number of new instructions so far in 2023. In May, the region broke the record again, with 95,947 new properties coming onto the market.

The region with the second highest volume of new instructions was the East of England, with 65,182 new properties coming onto the market.

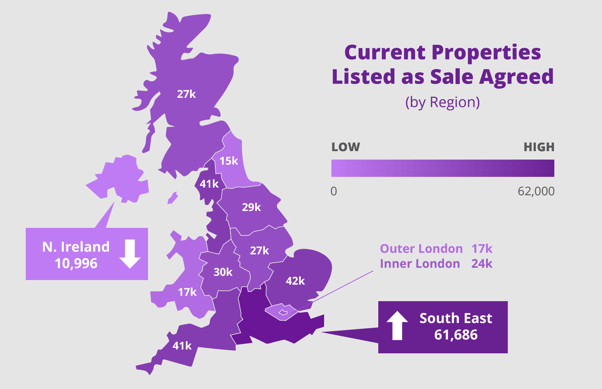

Current properties with sales agreed

Our sales agreed data covers all properties in the UK which are sold subject to contract and are currently on the conveyancing journey heading to completion. Sale agreed figures could be seen as an indicator of present demand, showing where people are currently in the process of moving. At the time of publication, 381,152 properties across the UK have sales agreed.

The South East continues to see the most activity with 61,686 properties being sold subject to contract. This is 984 more than was reported in our April Pulse for the South East. The East of England and the North West were runners-up with 41,563 and 41,476 properties at the sales agreed stage respectively.

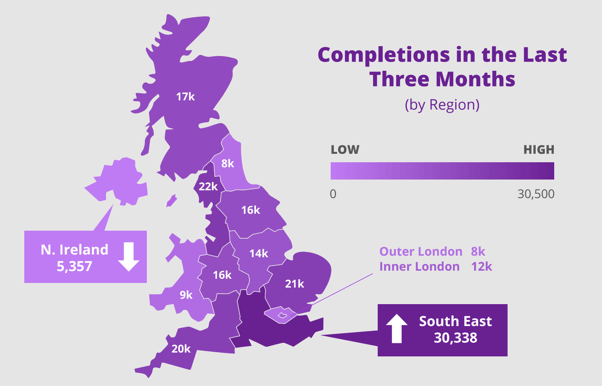

Completions in the last three months

Our completions data covers all residential properties in the UK which have undergone contract completion in the last three months. Therefore this data set covers all homes which have been newly purchased and moved into. In the three months to May 2023, 199,937 contract completions across the UK have been completed.

They were 30,338 completions in the three months to May in the South East. This region had the highest volume of completions, however, there were 621 fewer completions compared to April.

While Northern Ireland had the fewest completions overall, there were 408 more than what was recorded in April.

Colin Bradshaw, Chief Executive Officer at TwentyCi says of the latest data:

“As the dust settles from recent shocks, the residential market is emerging in remarkably robust shape. Whilst doomsday scenarios can’t be ruled out, it seems there is room for that old phrase ‘cautious optimism’.

As energy prices ease and interest rates and inflation look set to be near peaks or trending downwards, stable or upside scenarios have certainly started to look more credible”.