Homemover Pulse: UK Property Market November 2022

Welcome to our November 2022 Homemover Pulse where we take the pulse of the present UK property market and give a snapshot of current homemover activity.

With the UK’s largest and most sophisticated homemover database, we have unique access to data on house prices and residential property at every stage in the purchase journey. Here’s the latest update on the UK’s housing market.

Property Market Summary November 2022

- New Instructions: 407,956 new instructions

- Sales Agreed: 289,040 sales agreed

- Completions: 277,594 completions

UK House Price Growth

The latest Halifax house price index reports a further decrease in average house prices and the annual rate of growth. Find out more here.

Whilst transaction levels remain high, a decrease in demand is driving this downturn in property prices. Soaring mortgage rates are challenging for many, so this is expected to continue over the coming months.

The current state of the owner-occupied housing market: November 2022

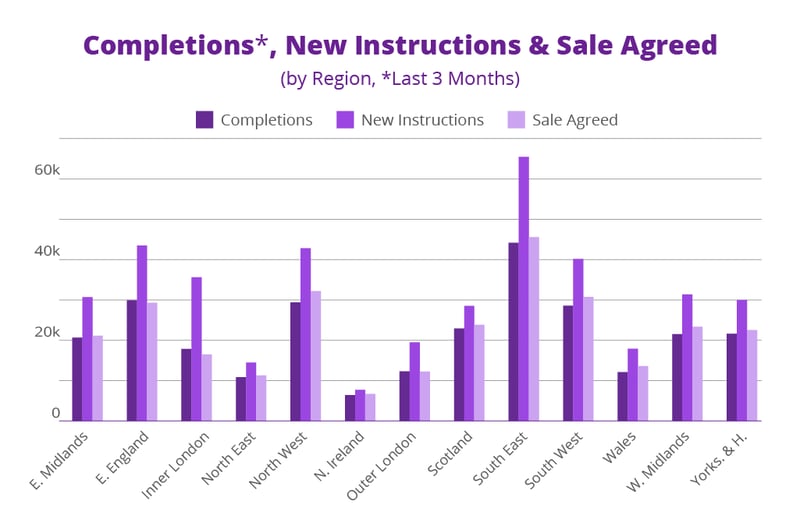

Currently, there are 407,956 residential properties available for sale and 289,040 properties with sales agreed across the country. There have also been 277,594 completions in the last three months. In the chart below, we have broken down these key stages of the home buying journey - new instructions, sale agreed and completions - by region of the UK.

Activity remains high in the South East, the UK’s largest region. In comparison with the pre-pandemic period of 2019 (which provides the best benchmark of the current market), new instructions increased slightly at +0.53%, whilst sales agreed decreased by -4.55% and completions increased by +8.76%.

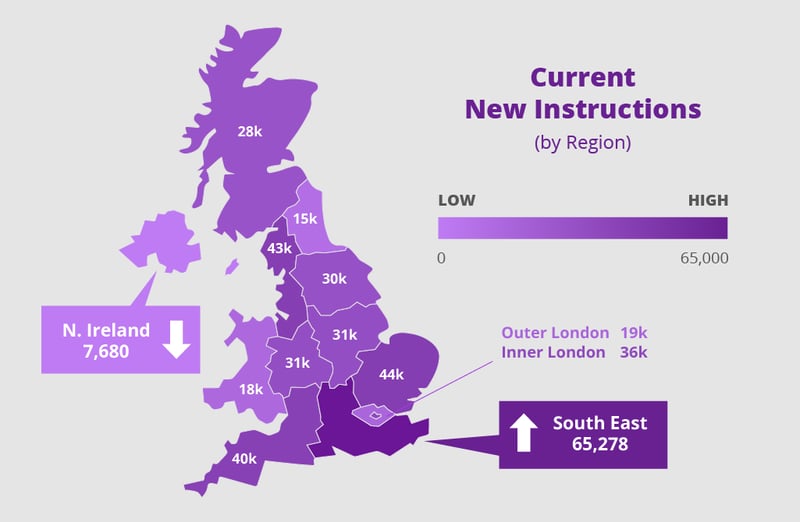

Current new instructions

Our new instructions data covers all residential properties in the UK that are available for sale. There are currently 407,956 properties listed for sale across the UK.

In comparison with 2019, overall new instructions have increased very slightly, at 0.53%. The majority of regions, however, have seen a decline in numbers since this time.

The biggest increases have been in Inner London (28.27%) and Outer London (8.44%) which shows a strong supply in these regions. At the other end of the scale, the North East’s new instruction numbers have decreased by -7.83%.

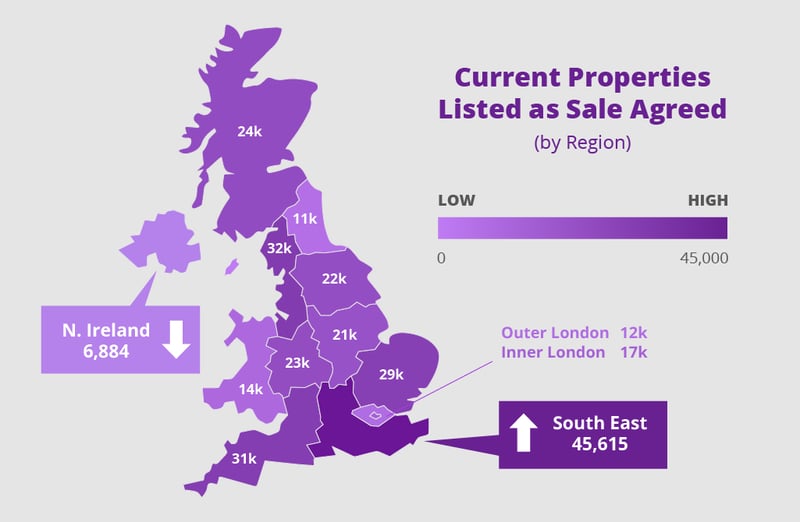

Current properties with sales agreed

Our sales agreed data covers all properties in the UK which are currently at the start of the conveyancing journey and are sold subject to contract. Sale agreed figures can be seen as an indicator of present demand, showing where people are currently in the process of moving to. Currently, there are 289,040 properties across the UK with sales agreed.

Overall SSTC figures are -4.55% down on the same time in 2019. With rising living costs and high mortgage rates still challenging most people’s finances, this decrease in overall demand is expected.

There’s an increased demand in Inner London of +5.62% when compared with 2019. So activity in Inner London is strong, although supply still outweighs demand by far. The majority of other regions showed lower demand than the last ‘normal’ comparison.

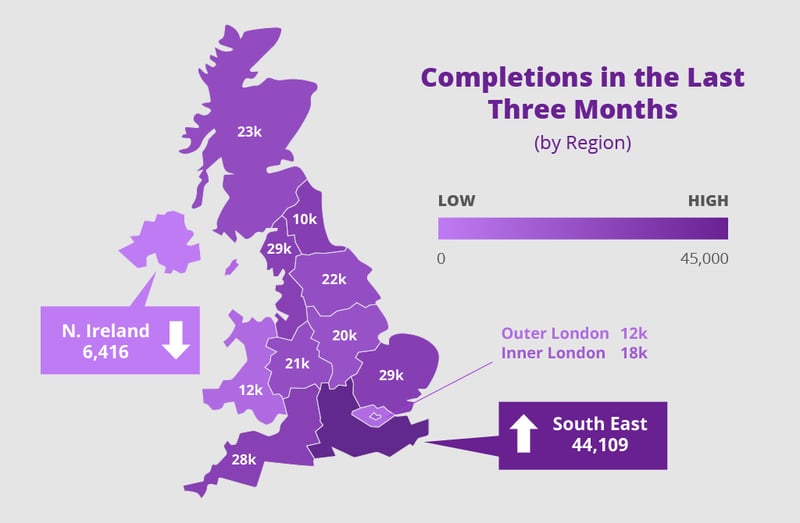

Completions in the last three months

Our completions data covers all residential properties in the UK which have undergone contract completion in the last three months. This data set, therefore, covers all homes which have been newly purchased and moved into. In the three months to November, there have been 277,594 contract completions across the UK.

This month, completions in the three months to November 2022 were +8.76% higher than the same period in 2019.

Activity in Inner London was once again high, with +32.02% more completions than in 2019. The movement was also strong in the North East with +22.32% more completions than in the same period in 2019. Outer London, the East of England and Scotland were also busy regions.

It’s likely that completions have been brought forward to secure lower mortgage rates that had been agreed upon at an earlier date. With this in mind, the end of 2022 will be a telling time in terms of the impact current mortgage rates are having on the market as a whole.

The homemover audience represents a large opportunity for many businesses, from the retail sector to utilities and insurance. Homemovers spend an average of £42,000 on goods and services related to their move in the months before and after moving house. As property and homemover data experts, TwentyCi can help you tap into this large, high-value audience. Get in touch to find out more.