How Council Tax on Second Homes is Warping the Property Market

During the summer, many of the UK’s most popular coastal towns are thriving. Restaurants are fully booked, footfall in local shops is surging and beaches are awash with bathers. But when the temperature starts falling, these bustling places suddenly fade into ghost towns. Much of the blame is placed on the second-home owner. The fair-weathered resident who only lives by the sea for a few weeks in summer and disappears to their main residence inland for the rest of the year.

The wealthiest have long been accused of buying up properties in these desirable tourist hotspots, pushing up house values and outpricing the locals. The second-home council tax was introduced in an attempt to curb this behaviour and to tackle the housing shortage by encouraging people to sell second homes to free up more properties for local residents. The extra revenue generated by the councils was suggested to help with the housing shortage. A YouGov poll found that 64% of people supported an increase in the second-home council tax premium.

The premium was first introduced in Wales, with Welsh local authorities authorised to charge a premium of up to 100 per cent on council tax on second homes since 1 April 2017. This was raised to an eye-watering 300 per cent in April 2023. According to The Times, 20 of 22 Welsh councils are now charging at least an extra 50 per cent. The rest of Britain followed suit. Scottish councils have been permitted to double second-home council tax since 2023, and in October 2025, MSPs voted to uncap premiums, which has sent shockwaves across second homeowners. According to The Telegraph, Scotland has 21,600 second homes, which is around 0.8% of the country’s entire housing stock, with popular hotspots in Arran, Skye and Wester Ross. Meanwhile, English councils are capped at 100% and have been allowed to introduce the premium since April of this year.

We wanted to investigate what kind of impact the second-home council tax has had on the property market. Let’s start by examining demand for properties.

How has the second home premium affected demand for properties

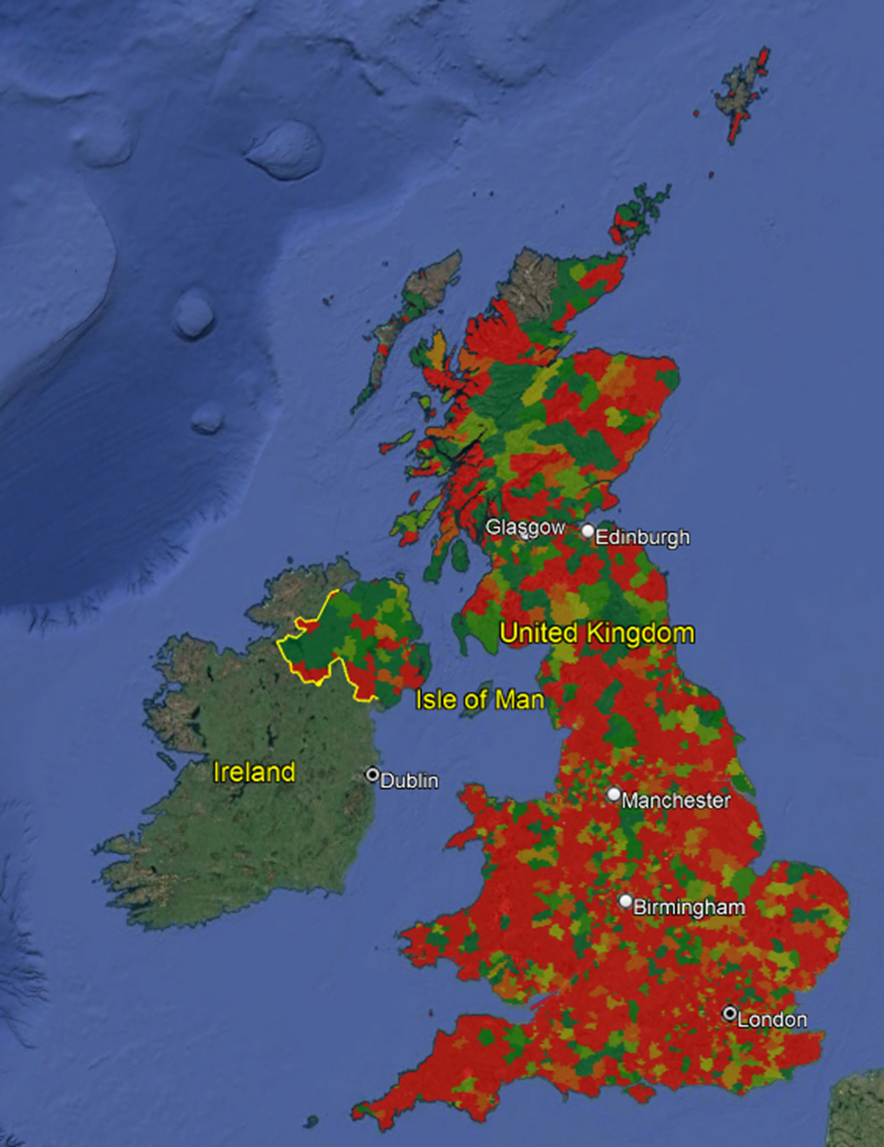

We can gauge property demand by examining how the Time to Sell has changed this year compared with the same period last year. The map below is aglow with red, indicating that Time to Sell is now taking longer. The pockets of green are where the Time to Sell a property has reduced:

Time to Sell a Property in 2025 versus 2024

You can see that most of the coastal areas, particularly Wales and Cornwall, where second homes are prevalent, are predominantly red, meaning the Time to Sell is taking longer and thus demand for properties is down.

In postcode district PE31 (Norfolk), it now takes 16% longer to sell a property, in SA70 (Tenby, Wales), this is 17% longer and in TR26 (St Ives, Cornwall), it takes a staggering 29% longer than it did in 2024. The trend indicates that it is now more difficult to sell properties by the coast and that the premium has made second-home ownership undesirable.

Looking at inflation trends in these holiday hotspots also gives an indication of how demand for properties might have been affected.

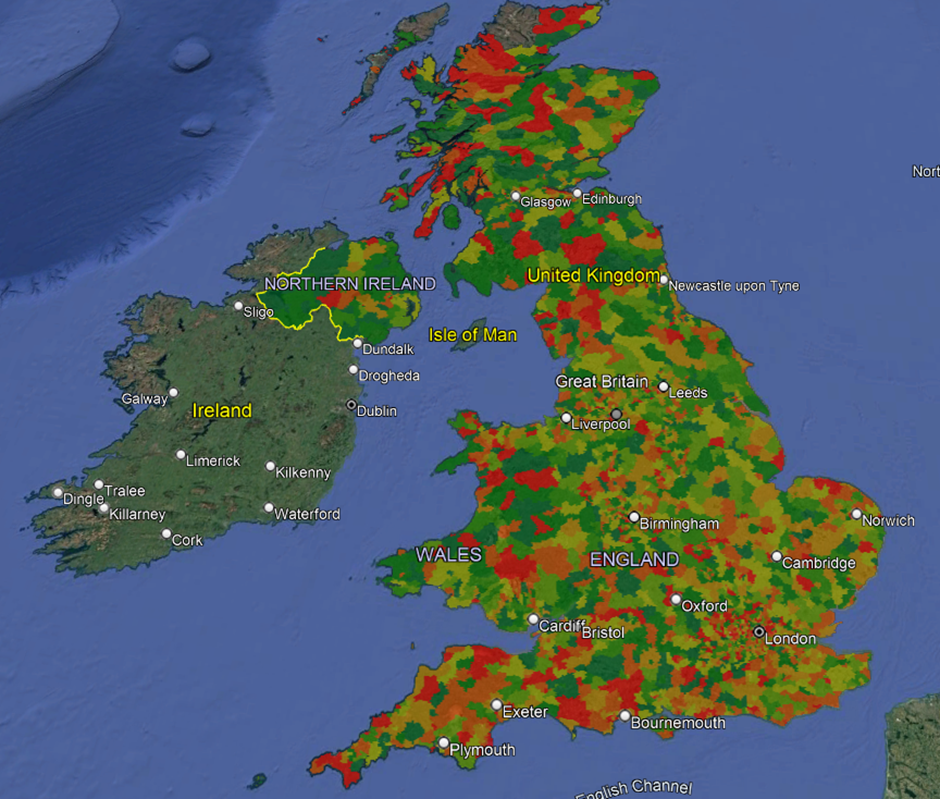

Inflationary changes in 2025 versus 2024

Some of the coastal areas, where many second homes are located, are markedly red. Red indicates that inflation has gone down, and green shows areas where inflation has risen. Take postcode district TR26 (St Ives), where inflation has gone down 12%, in TR7 (Newquay), inflation has dropped 11% and there’s an 18% fall in PL28 (Padstow).

Wales – where it all started

The premiums were first introduced in Wales in 2017 at a maximum of 100 per cent. As of 2023, Welsh councils were allowed to charge up to a staggering 300% council tax premium on second homes. According to The Times, the Welsh government stated there were 24,170 second homes in Wales in 2023-24. This was up from 23,974 the previous year but down slightly from 24,873 in 2022-23.

Gwynedd council hiked council tax for second homes to 150% in April 2023, and according to The Guardian, by the end of 2024, house prices had dropped by 12.4% as second-home owners tried to sell up. We have found year-on-year that inflation has gone up 0.6% in the coastal village of Abersoch, and Time to Sell has risen 25%. In Harlech, the Time to Sell has increased by a massive 52%, indicating a significant dip in demand for properties in that area.

In Ceredigion, The Telegraph reported that there was no exodus of second home owners, with the number of second homes only dropping by 16, despite the 150% council tax premium. Are these homeowners sucking up the premium or simply stuck, unable to sell their property? Inflation in the area has barely changed, at just a 0.3% rise.

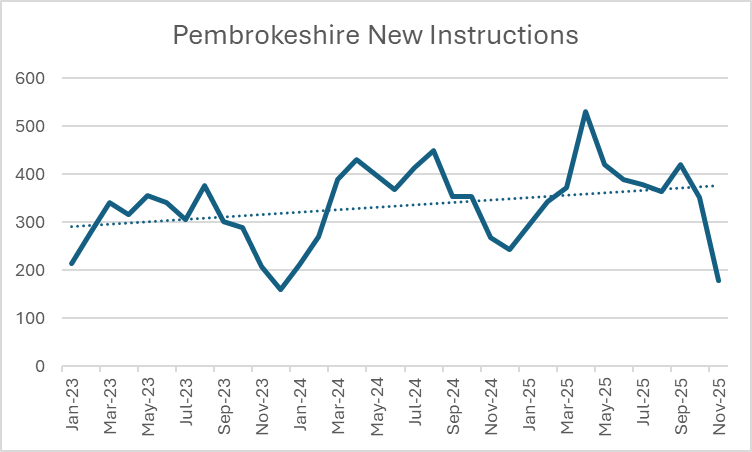

Pembrokeshire County Council makes for an interesting case study. In October of this year, councillors voted to reduce their council tax premium from 150% to 125% to lower the hardship on second-home owners. Before this, from April 2017, they charged 50%, from April 2022, they increased this to 100%, then doubled this to 200% from April 2024. The BBC reported that house prices in the county fell by 8.9%. After backlash about the high tax driving away second-home owners and harming tourism, it was reduced to 150% in April this year and then voted to be lowered further to 125% as of April 2026.

What has happened to property prices?

Let’s look further at Pembrokeshire and specifically Tenby, a popular second-home hotspot. In April 2023, the average property price in Tenby (SA70) was £393,564. This fell to £352,718 in April 2024 when the council upped the premium to 200%. They dropped the premium to 150% in April 2025, and property prices rose to £477,304 for the month of April 2025.

In South Hams, Devon (TQ6, TQ7, TQ9, TQ10, TQ11, PL21), the second home council tax was introduced in April 2025. Interestingly, the average property price in this area in April 2024 was £486,538, but dropped to £427,142 in April 2025.

North Devon Today reported that the second home premium hasn’t deterred people from buying up property in their region. They have stated that the number of second homes and holiday lets has increased to its highest level in seven years. When looking at property prices in the areas of Woolacombe, Croyde, Braunton and Instow (EX31, EX33, EX34 & EX39) and this is indicative of the average property price jumping up from £332,889 in April 2024 to £342,052 in April 2025.

Interestingly, though, London’s second home hotspot, Kensington and Chelsea (SW3, SW5, SW7, SW10, W2, W8, W10, W11, W14) has 7,898 second homes in the borough, and they currently do not charge a second home premium. Yet the average property price has fallen from £1,718,829 in April 2024 to £1,675,832 in April 2025, so other factors are at play here.

Locals priced out

Second-home premium objectors will argue that many second-home properties are in the higher price bands and, as such, very few local people can actually afford them, even if they were available. Take Wales, for example, according to The Times and Skipton, in areas with the highest second-home premiums, including Powys and Ceredigion, only 2.7 per cent of first-time buyers could afford to buy these properties. For Powys, the primary postcode areas are LD and SY, and the average property price this year to date for this area is £369K. The average salary for someone in Wales is £38,295, making the average property price 9.6 times the salary and out of reach for the average resident.

The story is similar when you look at some of the other holiday hotspot price-to-income ratios:

A mortgage is typically offered at 4 to 4.5 times your salary, making all of the locations above unaffordable for the average person. This suggests that property prices in holiday hotspots may fall due to affordability issues and because buyers are unwilling to pay the second-home premium.

These second-home properties entering the market are likely contributing to the exceptionally high levels of price reductions in the property market in 2025. To date this year, we have observed over one million price reduction events, the largest amount we have ever recorded. Among concluded listings, a significant 38.7% have experienced a price reduction. There are countless stories of people reducing the on-market price of their second home to try to shift it.

Increased New Instructions

The aim of the premium was to get second-home owners to sell up and open up property to locals. There are certainly instances where New Instructions have increased in second-home hotspots.

It’s interesting to note that, as a reaction to the second home premium, many homeowners have tried payment avoidance tactics to duck out of paying. Some have converted second homes into holiday lets, and others have listed them for sale as they are then exempt from the premium for 12 months. Do they actually have any intention of selling, or are they just evading the extra fees? According to the Gov.uk website, in England, 170,000 dwellings are being charged the newly introduced Second Homes Premium. This is out of the 268,000 dwellings recorded as second homes. According to The Times, more than half of second homeowners in England were given an exemption from double council tax, and of these, 34% of owners had put their properties up for sale.

In Pembrokeshire, one in five owners has been granted a one-year exemption from the premium as they have either listed their property for sale or let. Whether they have the intention to do so or not is another matter! Let’s look at what New Instructions in the country looks like:

Pembrokeshire:

The trend line is going up, showing that New Instructions have risen over time since January 2023.

We’ve taken a look at some other second-home hotspots to see if New Instructions have increased over time.

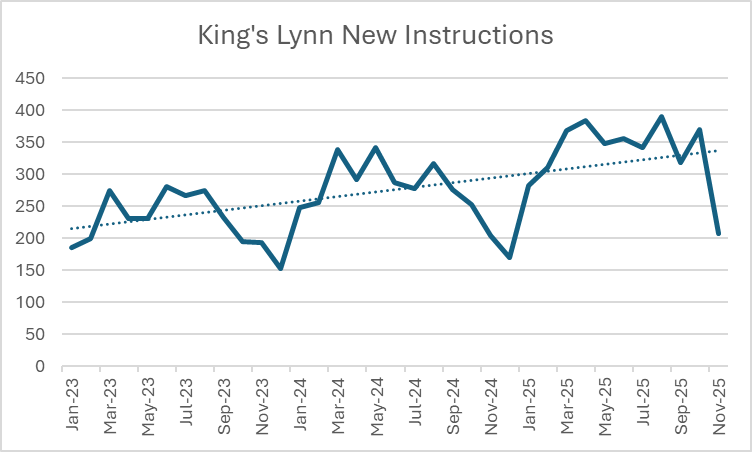

King’s Lynn:

In King’s Lynn, which includes second-home hotspot Burnham Market, New Instructions are clearly on the rise. The second home council tax was introduced in April 2025, and you can see New Instructions trending higher in 2025 compared to the previous two years.

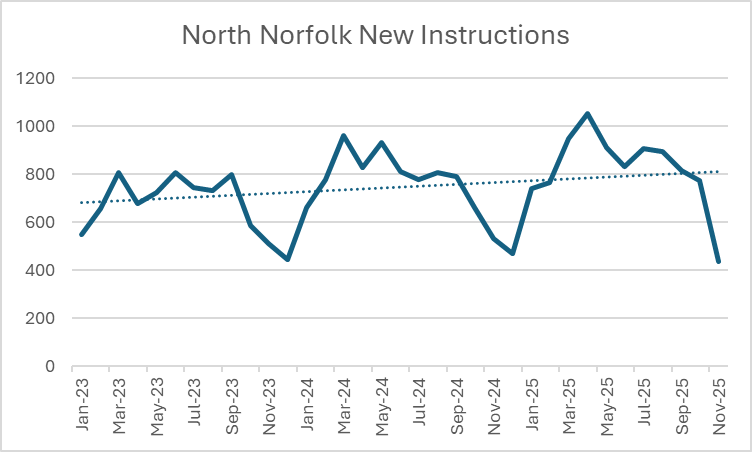

North Norfolk:

North Norfolk is a popular hotspot for second homes, especially amongst affluent buyers from London and Cambridge. Cromer, with its traditional charm, Sheringham, famous for sandy beaches and Wells-next-the-Sea, known for its colourful beach huts, are all popular second home locations in North Norfolk. There’s a noticeable spike around April 2025 when the new second home premium was introduced by North Norfolk District Council.

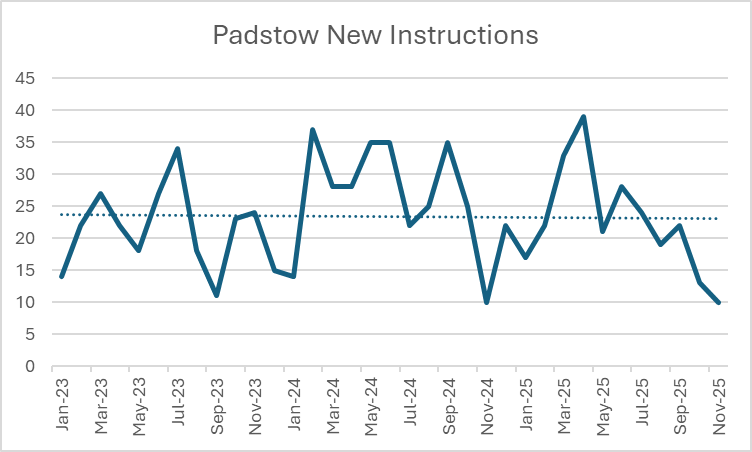

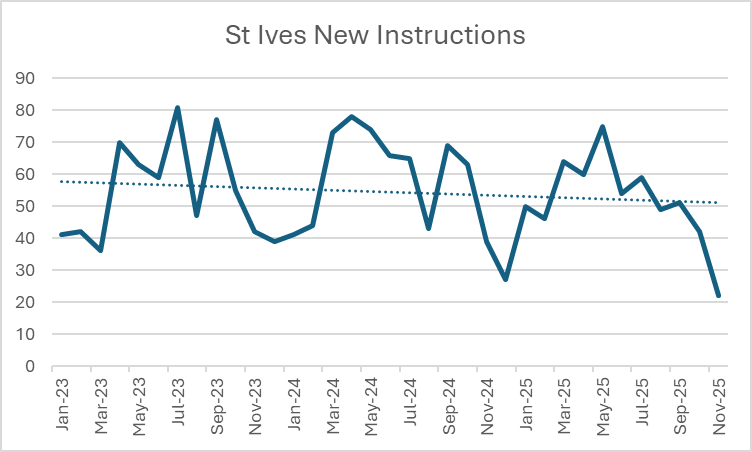

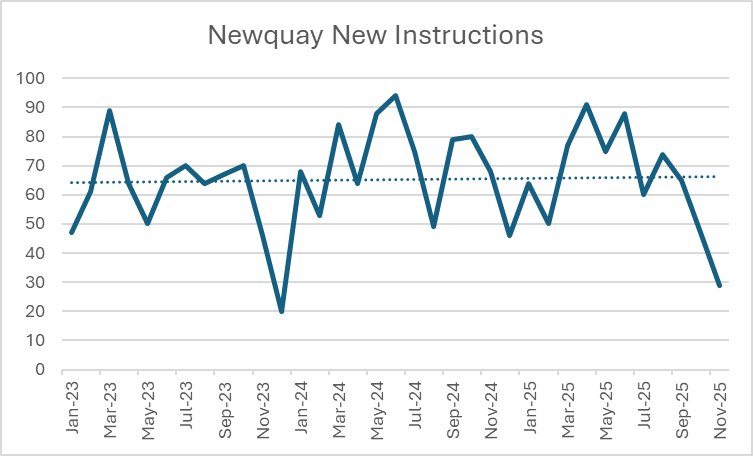

Cornwall:

According to The Times, Cornwall has about 14,000 second home properties (5% of all second homes in England). We’re not seeing New Instructions rising when we look at two of the biggest second home hotspots in Padstow and St Ives, and only a minor increase in Newquay.

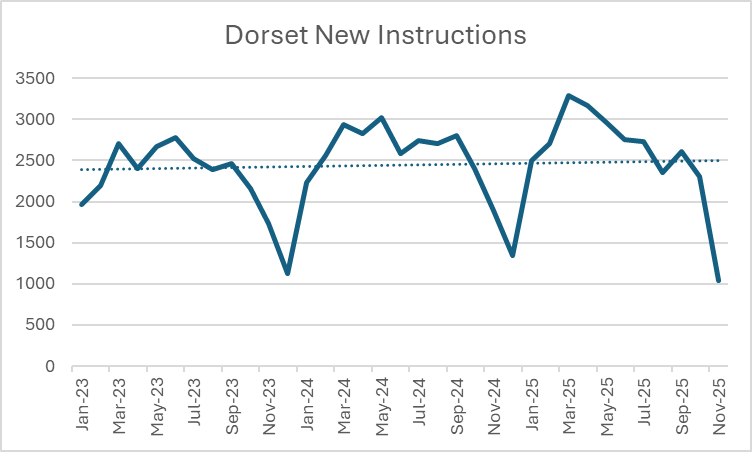

Dorset:

Dorset has around 6,000 second homes. The council introduced a 100% premium in April 2025. At the same time, they abolished the furnished holiday lets rules (where homeowners can fully deduct their mortgage interest from their taxable income so long as properties were let for 105 days in a tax year). This has led to increased costs, uncertainty and some homeowners have just sold up altogether, which you can see the peak in the graph around this time.

Conclusion

Historically, having lots of second homes has driven up inflation as it reduces the number of homes available for residents, so competition for the remaining housing increases. In the current cost of living crisis, having a second home is increasingly becoming out of reach for many because of food, energy and mortgage costs all going up. This is likely putting people off owning another property, and the second home premium only exacerbates this, driving demand down and slowing house price growth. Less localised overheating in hotspots means fewer inflation hotspots.

There’s an argument that second homeowners only use the property for 3 or 4 weeks a year, so they’re not benefiting the local economy, whereas the excessive council tax will. On the other hand, second homeowners can afford these properties and are bringing in custom to these areas that rely heavily on tourism.

The problem with the tax is that it stunts aspiration, discouraging second home ownership, which can reduce demand for homes and cause house prices overall to fall. A further issue is that The Telegraph revealed as little as 9p in every £1 generated will be spent to tackle the housing shortage and free up homes for locals in holiday hotspots. The reason? The Government decided not to ring-fence where the revenue generated is spent, so actually the premium became quite the cash cow for local councils as they’re under no obligation on what they spend the money raised on.

We will continue to monitor the second-home trend over time to see what further impact this has had on the property market, particularly as this was only introduced in England in April of this year.