The growth of million pound properties in 2021

Before the global financial crisis, TwentyCi worked with a property investment company who set out to make “property millionaires” from investors by selling off plan property on a global basis. Their mantra at the time was that 80% of millionaires in the UK made their money through property. This is a statistic that we regularly use to the present day. The “credit crunch” in 2007 gave a reality check to some of these investors, who were left with property and negative equity. In parts of the world where the local population lacked the wealth to support such a vibrant property market, many of these investors are still awaiting a positive return.

At that time, a property millionaire in the UK – and by this we mean people sitting on £1million or more equity in their property ownership – was quite rare. These days, with property prices in England rising by over 10% in the last financial year, it seems that many are owned by fairly ordinary individuals and this number is rising.

In this post, we look at where these properties are in the UK; whether the volumes of transactions are increasing or not and by how much; and finally, are most of the transactions involving £1million plus properties caused by upsizing or downsizing.

Million Pound Property Locations in the UK

According to our own property data and valuation estimates, there are currently over 770,000 properties that are valued at £1million or more. This is approximately 2.5% of all UK residential property.

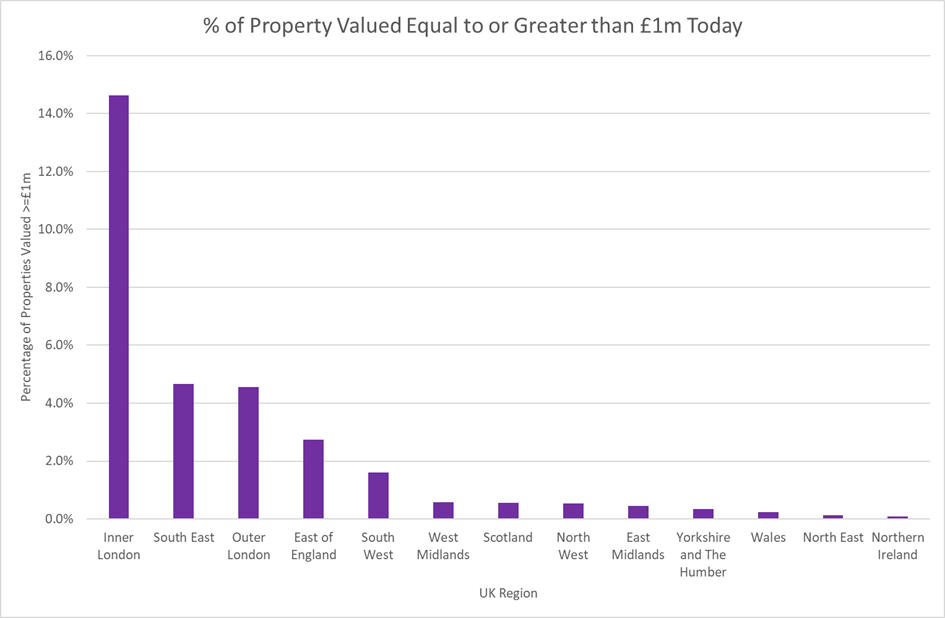

Our first chart displays the breakdown of properties valued at £1million or more by UK region.

It is not surprising that Inner London dominates the chart, with 14.6% of all properties in this region being valued at greater than £1million. In fact, 52% of all UK residential properties valued at greater than £1million are in London, with a massive 43% of these in Inner London.

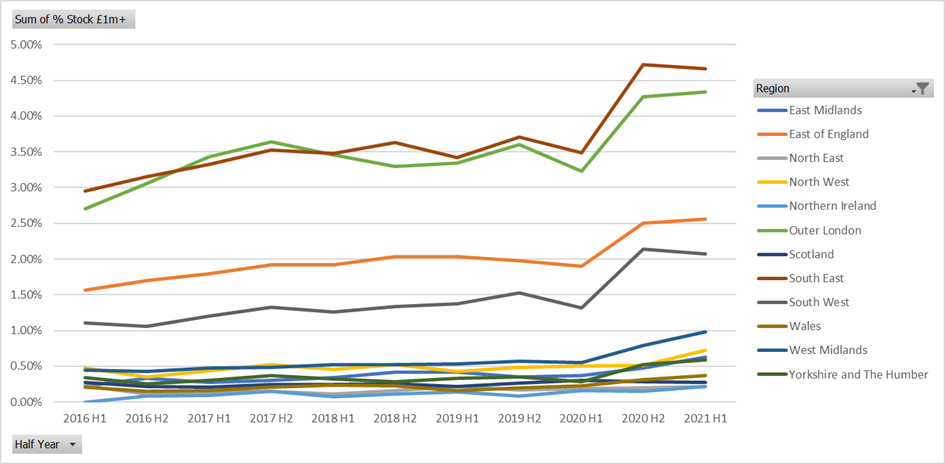

What this hides however is the growth of properties valued at £1million or more. The following chart displays this.

In Wales for example, there are now 3.8 times the number of £1million properties than there were in January 2015. We also see astonishing growth in the Midlands and the North, although to be fair, some of these regions did start from a low base.

Million Pound Property Transactions

Since the beginning of 2016, we have observed over 110,000 million pound property transactions. These are growing fastest in the East Midlands, where the compound annual growth rate of £1million plus transactions has grown on average by 32% per annum. Inner London growth in the same period was only 6% by comparison.

If we strip out Inner London, where the growth in the volume of transactions is comparatively flat, the following chart displays the growth in volume by region.

This chart tells a very important story in that much of the growth has occurred in the last 18 months – since the stamp duty holiday was put into place. The South East tops the list, where 4.7% of all transactions were conducted on £1million plus properties. This rose from 3.5% in the first half of 2020.

Why are People Selling more Million Pound Properties?

In order to look at this aspect in more detail, we decided to join forces with our sister company View My Chain to obtain chain data on £1million plus property transactions.

Before we looked, we anticipated that a great many of the occupants of £1million plus properties, given the recent price rises and pandemic, would look to cash in on their equity and downsize.

In fact, what we establish was that over 50% of all £1million plus property purchases where actually upsizing into the greater than £1million band. Whereas 33% of transactions involved downsizers moving out of the £1million plus band and 17% moved from one £1million plus property into another one.

To the future

The property industry has seen extraordinary times in the last two years, and this has led to an increase in the volume of £1million plus property available and an increase in the volume of £1million plus properties being transacted.

The big question is how sustainable are the recent volume and price rises?

In the short term, the vast majority of stamp duty savings have now disappeared. In the longer term, as the population gets older and starts to release more equity, how many amongst us can afford to finance such a purchase? Even with 10% deposit, the purchase of a £1million property would require an annual salary north of £200,000.

It remains to be seen if prices at the top end of the property price spectrum will continue to increase or if ever more of these properties are split up into several more affordable flats which people can buy.

For more insight into the UK property market, sign up to our weekly client briefings, where we bring you the latest news and analysis straight to your inbox. If you want to find out more about our property data, simply get in touch.