The Secret to Marketing to Affluent Customers: Insights for Luxury Furniture Retailers

Like a will-o'-the-wisp, the most affluent of society can be elusive. Though a complicated customer to reach for the retailer, they remain one of the most active buyers, despite ongoing economic pressures like inflation and higher interest rates:

“The top half of the disposable income distribution accounted for two-thirds of total household expenditure in the latest data (ONS).”

-The Bank of England, citing ONS data for Q2 2025

How do you connect with this customer who desires exclusivity and bespoke experiences? Mass marketing tactics often fall short, and the marketer must adopt niche strategies to reach them. Surely there’s an easier way?

If you are a luxury home furnishing retailer, you have probably explored targeting interior designers and architects, as well as magazines and trade publications. You are working hard on referrals and sponsorships and attending the right networking events. All of this is great, but there is a better alternative. An additional layer of targeting that the luxury retailer tends to overlook, or is simply blind to, is residential property market data - especially homemover activity. Homemovers are big spenders and a prime audience for retailers. This is the avenue you should pursue if you want to reach elusive high-net-worth individuals (HNWI).

What if you could have a crystal ball predicting who and when to target as they are putting their house on sale, or moving to a new one? More on this later…

HNWI and the property market

We can’t ignore that the second half of 2025 has been challenging for the luxury property market, with speculation circulating since August about how higher-priced property owners might be affected by potential tax hikes. Many homeowners delayed their relocation plans until the official proposals were announced, and this is reflected in the New Instruction data below.

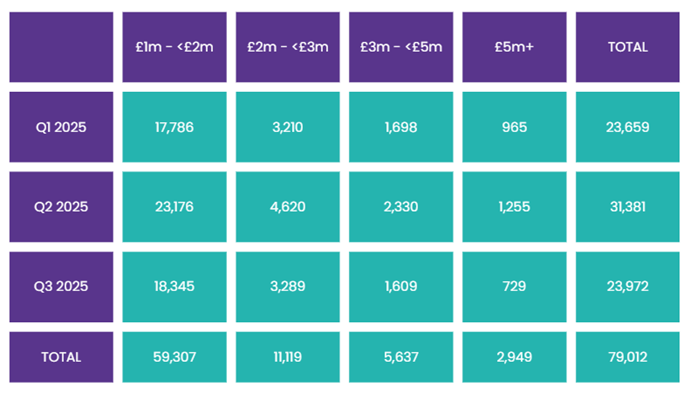

Q2 saw the highest New Instructions across every price band above £1 million in 2025, followed by a decline across the board in Q3. Savills reports that £2.94 billion has been spent on homes priced over £5 million, although activity remains sluggish compared with last year.

Even so, a healthy number of luxury properties (over £1m) have still come to market this year (79k), signalling a strong target customer base. Many people continue to move for lifestyle reasons regardless of economic conditions. Our analysis shows that 125,805 properties in the UK are valued above £2 million, with 115,430 properties priced between £2 million and £5 million, and 10,375 properties above £5 million.

Number of properties over £2m in the UK:

Now that a new mansion tax has been announced in the budget for properties priced over £2 million in England, the question is whether we will see a flurry of activity. Some asset-rich but cash-poor owners may choose to list quickly to avoid the mansion tax, and others may look to leave high-value regions such as London and the South East in favour of more affordable areas. Conversely, many may stay put, given the option to defer payment until death or sale of the property.

We will be monitoring Q4 with interest and will provide further updates! Keep an eye out for our Property and Homemover report released in January, which will include further analysis.

Number of properties over £1m listed for sale in Q1, Q2 & Q3 2025:

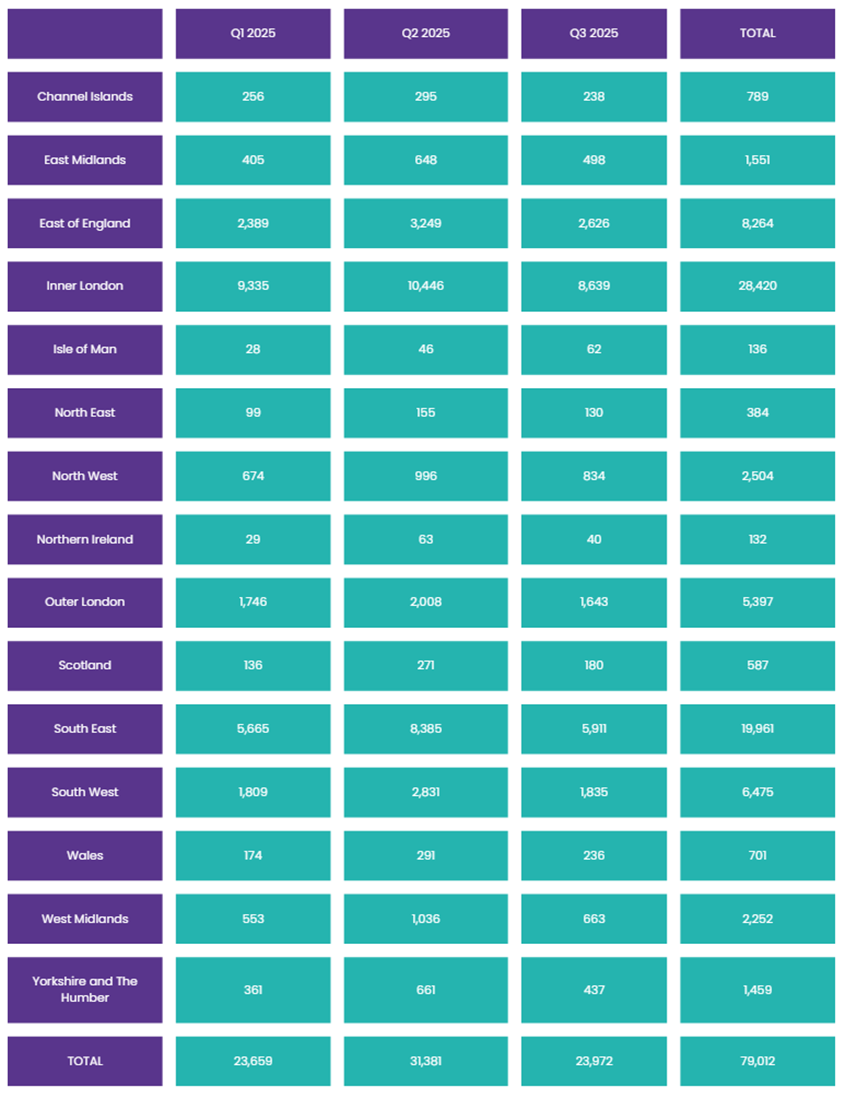

Looking at the regional picture, it is clear where luxury homes coming to market are concentrated. With the greatest volumes of high-valued properties, naturally Inner London and the South-East lead, with a growing number of expensive properties coming to market in the East of England:

Number of properties over £1m listed for sale in Q1, Q2 & Q3 2025 per region:

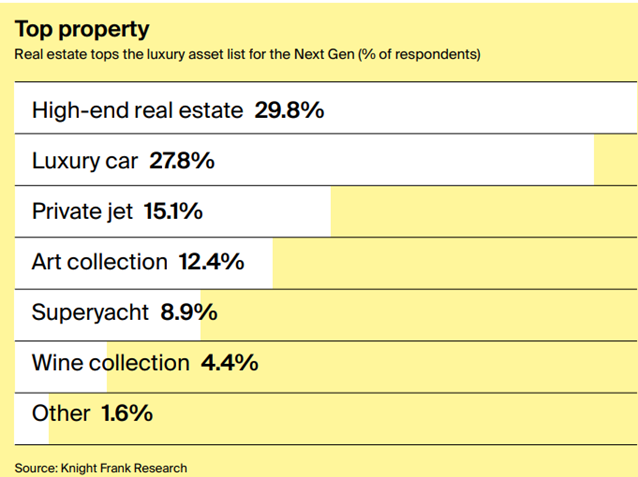

Property is still a sought-after asset for the HNWI. In fact, Knight Frank's Wealth Report surveyed the next generation of 18- to 35-year-olds and found real estate topped the list of luxury assets they’d most like to own.

Retail Economics reported where 2025 discretionary spending is being concentrated and revealed that 28.6% of affluent households are investing in their living spaces. Savills Spotlight on Wealth Trends confirms that, "property remains an integral part of wealth portfolios and a key area of evolving preferences… ultimately, buying prime residential real estate is about more than owning a home, it is a base that supports a lifestyle, reflects values and offers comfort alongside long-term value.”

What does this all mean for luxury home furnishing retailers?

The money is where the homemovers are.

Retail spending in 2025 has been a mixed bag, but furniture has powered through. The Barclays Consumer Spend Report found furniture spend had risen 11.6% year-on-year in August, sustained across nine successive months. Post-August, many consumers held off, waiting for Black Friday. The British Retail Consortium stated that October was subdued, as spending was delayed, but furniture was less impacted because people were preparing their homes ahead of Christmas.

The audience spending the most, though, is the homemover. With one large national furniture retailer, we found the typical homemover spent nearly 56% more than a non-mover. The same applies to HNWI.

Property data tells you exactly where each homemover sits in their journey: For Sale, Sold Subject to Contract, or Moved In. You can target them at the point when they're most likely to spend, rather than blasting everyone and hoping for the best.

At TwentyCi, we specialise in marketing to the homemover. We even have a Likely-To-Instruct model that identifies customers before they list their home, with 50% accuracy. So, you're reaching people before they've made their move public.

Stage to sell

One effective way for furniture retailers to reach affluent customers is by partnering with professional staging companies. These firms operate at the intersection of high-value property transactions and design-led decision-making, placing furniture directly inside premium homes and in front of affluent homemovers at the point of influence. In doing so, staging companies shape how luxury properties are presented, and, by extension, the furniture and design choices affluent buyers aspire to. Elaine Penhaul from Lemon and Lime Interiors adds:

“Staging is an opportunity not only for the specialist businesses but also for their suppliers. Luxury homes require luxury furniture for staging as well as for living. A home, professionally presented as market-ready to attract the next HNWI as a buyer, will use anything from 100 to 500 individual items of furniture, artwork and accessories. The stagers, such as Lemon and Lime, specialising in high value properties, source furniture to showcase the lifestyle and aesthetic of the new owner in order to ensure there is competitive bidding on a home and the best offer can be accepted. For luxury home furnishing retailers, this represents a new opportunity. Many buyers who fall in love with a home when it is staged make the decision to buy the furniture they have seen in situ. For a retailer, working alongside a stager in the HNW market means instant access to the perfect client who is already bought into a look. The initial staging can then be enhanced with design services and the opportunity to upsell for the gym, the cinema room or the leisure suite. In addition, there is a direct link to the seller of the home who are themselves moving to a new property. Lemon and Lime report that often a seller has fallen in love with the staging in the home they have moved from and invite them in to help with furniture and design as they move.”

Widely popular across the pond, staging homes is picking up pace here in the UK and presents a real opportunity for the savvy furniture retailer looking to gain access to HNWIs. Elaine adds:

“One of the effects we anticipate the new property taxes for higher value homes will have is that there will be more people keen to sell than buyers, at least in the short term. As with most changes, especially one which in monetary terms is not hugely significant vs the property value, this will settle over the next 12 months or so. In the meantime, it will be really important for those that need to sell to attract the smaller buyer pool with strategic pricing and great marketing. Over the last 10 years, staging has become a strong tactic for those wishing to attract a high offer quickly. Lemon and Lime Interiors, a leading UK property staging business, has seen a tenfold increase in revenue since 2015, with interest coming from home sellers and estate agents across the UK.”

The mansion tax will certainly shake up the upper end of the property market and with many now looking to sell before the tax comes into effect, there’s never been a greater opportunity than now for the luxury furniture retailer to focus their attention on the homemover.

The detail matters

We track the property market, connecting retailers with owners of properties on the higher end of the spectrum. We also provide marketing services targeted at those homeowners with properties over £500,000, £750,000, £1 million… whatever value you feel is relevant for your brand. We can drill down further still with our DOMUS database.

We have access to over 350 property attributes, everything from whether a property has a garage to the oldest resident in the home. For luxury retailers, we usually target specific postcodes and go after the most expensive locations to live. We can filter down to only those properties that have four or more floors or more than four bedrooms, or target properties that have gyms, cinemas or stables and those with gated drives or private roads. Some other interesting luxury property attributes include tennis courts, helicopter pads, hangars, swimming pools or even lakes.

Some of these attributes matter more than you'd think. A luxury kitchen retailer might target only properties with kitchen islands or kitchens above a certain size. If you sell large, non-modular furniture that can't be disassembled, you might target properties with wide doorways. That's how specific you can get.

Now that you know we have access to the owners of the highest property prices, how do we reach them? Many of our successful campaigns use direct mail at the forefront. Direct mail has a timeless appeal. As luxury brands need to offer something exclusive, direct mail is ideal because it appeals to the senses, thanks to its tangibility. It leaves a memorable experience. According to Furniture News, 11% of shoppers discovered new furniture through direct mail advertising so it’s a worthy marketing tool to have in your arsenal.

The physical presence of direct mail commands attention, and it typically has a longer lifespan, remaining in the home. This repeated exposure to the brand leads to better brand recall. Digital advertising is saturated, so to the customer, receiving an expertly crafted piece of direct mail can signal a sense of exclusivity, and it shows that you value them. You can tap into that need for exclusivity by offering VIP invitations or exclusive offers. Unveil your limited-edition items or tailor-made collections to captivate this sophisticated audience.

The point is this: you don't need costly magazine adverts or pricey VIP events to reach affluent customers. You need to know when they're moving and what their home looks like. The rest is just getting the timing right.