Homemover Pulse: UK Property Market June 2023

Welcome to our June 2023 Homemover Pulse where we take the pulse of the present UK property market and give a snapshot of current homemover activity.

With the UK’s largest and most sophisticated homemover database, we have unique access to house prices and residential property data at every stage in the purchase journey. Here’s the latest update on the UK’s housing market.

Property Market Summary June 2023

- New Instructions: 607,954

- Sold Subject to Contract: 406,214

- Completions in the last three months: 186,613

UK House Price Growth

The average house price for a property in the UK is £286,532. This is a 0.1% decrease in the average price since last year.

According to the Halifax House Price Index: “As expected the brief upturn we saw in the housing market in the first quarter of this year has faded, with the impact of higher interest rates gradually feeding through to household budgets, and in particular those with fixed rate mortgage deals coming to an end.”

See the full Halifax House Price Index report for May.

The current state of the owner-occupied housing market: June 2023

607,954 properties are currently on the market across the UK. This is 24,342 more than highlighted in our May Pulse.

There were also 25,062 more properties sold subject to contract than in May (406,214 compared to 381,152). However, there were 13,324 fewer properties exchanged (186,613 compared to 199,937 in May).

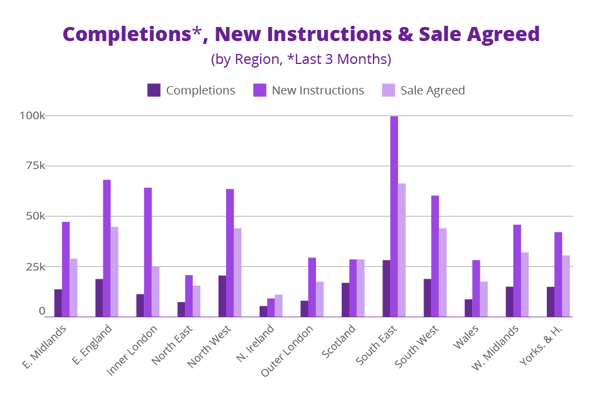

Below, the key stages of the home buying process have been broken down by stages and region.

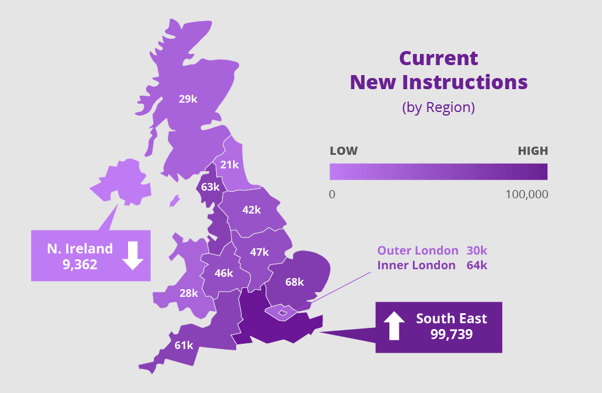

Current new instructions

Our new instructions data covers all residential properties in the UK that are currently available for sale. At the time of publication, there were 607,954 residential properties available for sale across the UK.

In May, the South East broke its own record of reporting the highest number of new instructions in one month so far in 2023. In June, that record was broken again, with the South East reporting 99,739 new property instructions.

The region with the second highest number of new instructions was, similar to May, the East of England with 67,972 new listings.

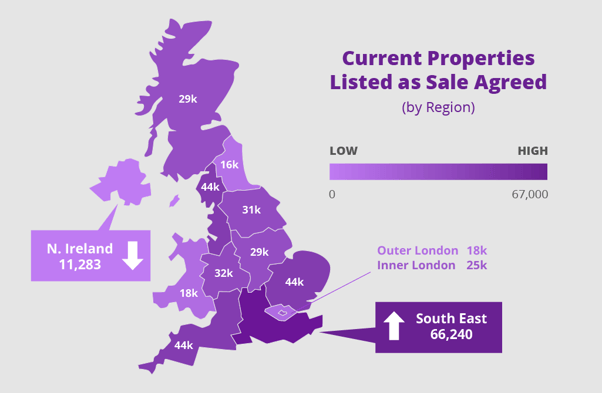

Current properties with sales agreed

Our sales agreed data covers all properties in the UK which are sold subject to contract and are currently on the conveyancing journey heading to completion. Sale agreed figures could be seen as an indicator of present demand, showing where people are currently in the process of moving. At the time of publication, 406,214 properties across the UK have sales agreed.

The top five regions with the highest number of properties reported as sold subject to contract are:

- South East - 66,240 properties

- East of England - 44,363 properties

- North West - 44,079 properties

- South West - 43,812 properties

- West Midlands - 32,227 properties

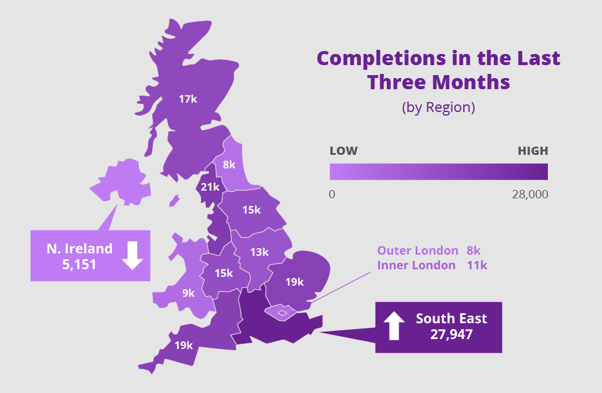

Completions in the last three months

Our completions data covers all residential properties in the UK which have undergone contract completion in the last three months. Therefore this data set covers all homes which have been newly purchased and moved into. In the three months to June 2023, 186,613 contract completions across the UK have been completed.

There were 13,324 fewer property sale completions in the three months to June compared to the three months to May.

The highest-performing region continues to be the South East, with 27,947 recorded property completions in June. This was followed by the North West, with 20,673 recorded completions.

Northern Ireland saw the lowest number of completions, with 5,151 recorded. The second-lowest completions by region was the North East, with 7,759 recorded property completions.

Colin Bradshaw, Chief Executive Officer observed -

“In spite of energy prices easing, inflation remains stubbornly high and we anticipate the Bank of England adjusting interest rates still further. Whilst we are far from the doomsday scenarios predicted, the residential property market remains subdued, albeit with activity levels reflective of the last “normal” market in 2019”.

Subscribe to receive the Market Pulse in your inbox below: