Marketing strategies for the cost of living crisis 2022

The cost of living crisis is having a considerable impact on consumer spending and is likely to continue for the foreseeable future.

On the back of reduced spending during the pandemic comes a fresh challenge for retailers - the cost of living crisis. While we don't know the full extent of the impact yet, evidence is already showing that British people are pulling back on spending.

Homemovers and homeowners are one steady audience that remains robust amidst a financial or economic downturn. Our recent Q2 2022 homemover and homeowner report published in July showed that over the previous 12 months, 1.4 million households had moved properties, with another 1.2 million forecasted to make a move in the 12 months following this report.

Colin Bradshaw, Managing Director of TwentyCi, had this to say:

"Our previous observation that the owner-occupied sector appears to be detached from the woes that are befalling the wider economy continues to hold true."

However, this doesn't mean that retailers who target homemovers and homeowners as their main audience have nothing to worry about. While audiences in the moving or recently moved categories will still need to invest in goods and services, their behaviour may shift slightly, something we will explore further on in this post.

With that in mind, retailers in this sector will need flexibility in their marketing strategy to ensure they are consistently providing value and helping consumers spend their money wisely, whilst protecting themselves so that they can make it through the crisis and come out of the other end in as strong a position as possible.

We will look at government data as well as data from TwentyCi and other sources to help retailers reposition their strategies to help reduce the impact of the crisis as much as possible.

But first, let's take a step back:

When did the cost of living crisis start?

While the cost of living squeeze has been at the forefront of the news in recent weeks, it officially began in late 2021 according to the Institute of Government.

Fuel shortages, supply chain disruption, shipping costs and more are causing rapid increases in consumer prices. These are increasing faster than average wage growth, making 'real salaries' drop across the UK.

As a result, consumers are having to make cutbacks, directly impacting retailers.

In June, we talked about the post-pandemic spending bubble and the effect this was having on homeowners. Retail spending figures were already down year-on-year by 1.1%, and we expect the cost of living crisis to disrupt this even more.

How the rising costs of living will impact retailers

The rising cost of products is leaving people across the UK looking to cut costs where they can. This means that retailers need to pivot their marketing strategy and marketing communications to remain profitable.

As consumers are less likely to part with their money, increasing the value and experience gained from investing in new products will need to be a focal point for any brand looking to remain competitive.

More people are expected to stay home in a bid to save. If we look at consumer spending amidst the pandemic, many turned to online shopping. In response, many businesses moved their advertising focus online, allocating more budget to their eCommerce website in a bid to maintain revenue forecasts.

While customers shopping online may not be quite as high as pandemic levels since people are not legally required to stay at home, it's fair to say that online shopping will continue to be a strong advertising channel for retailers.

Targeting the right audience: the value of home movers

We know that consumers amidst a house move are nine times more likely to invest in home furnishings and improvement-related purchases, and typically spend 50% more than consumers who aren't in the process of moving.

We know that consumers amidst a house move are nine times more likely to invest in home furnishings and improvement-related purchases, and typically spend 50% more than consumers who aren't in the process of moving.

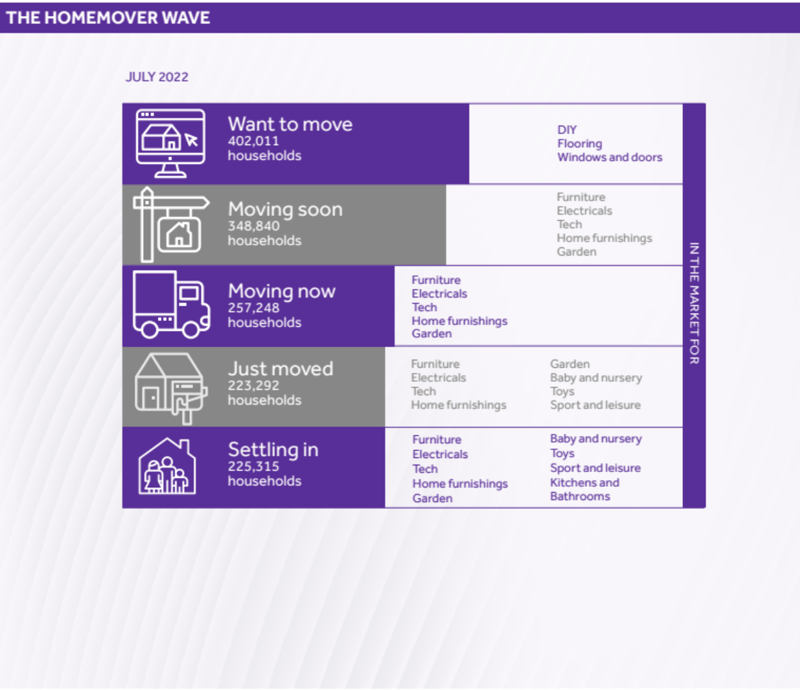

The process takes months and the types of products and services movers will be investing in will change too:

People just beginning their search for a new property will likely be shopping for DIY goods, new flooring, windows and doors to help their current home sell for the greatest value possible.

Those who have perhaps had an offer on a new home accepted and are planning their move will likely be shopping for new furniture, electricals and household tech, as well as garden equipment, furniture and general home furnishings.

Once the move is complete, shoppers will likely still be looking at furniture and home furnishings, electricals and tech, and garden items but may also be shopping for sports and leisure equipment, and baby and nursery toys if they have young children.

During the months following a move, known as the settling-in period, homeowners will still be shopping for all of the things mentioned above, as well as looking into kitchen and bathroom upgrades as they decide what they want to do with their new space.

While the cost of living crisis shouldn't change this too much as homemovers have a need to buy these products and they can not be delayed, we may see some behaviour shifts in response to the current climate and a limited disposable income.

In 2009, The Harvard Business Review reviewed the impact recessions have on consumer behaviour, and grouped shoppers into four categories:

Slam-on-the-breaks shoppers

These will be consumers who will be postponing, substituting or decreasing spending during the course of the crisis and likely for a time after. This can include consumers on higher incomes, especially if there is a change in circumstance for them.

Pained-but-patient shoppers

Consumers in this category will be optimistic in the long term but not so much in the medium to short term. They will likely be pulling back on their budgets, but not to the extent as slam-on-the-breaks shoppers. However, they could easily transition into that group should the news continue to worsen.

Comfortable well-off shoppers

This group of people will likely not change their spending habits anywhere near as much as the previous two groups - although this group will likely contain consumers in the top 5% income bracket. They may become a little more selective than normal but there won't be a considerable shift in buying behaviour.

Live-for-today shoppers

Rather than cut back on spending entirely, live-for-today shoppers will likely extend their purchasing timetable but are otherwise unlikely to change how they are spending money.

The Harvard Business Review also had this to say:

"The wave of bad economic news is eroding confidence and buying power, driving consumers to adjust their behavior in fundamental and perhaps permanent ways."

While this was discussing a different financial downturn, the sentiments are still valid for the current situation.

So, in addition to responding to customers being less likely to spend, understanding recession psychology could be key to pivoting marketing campaigns during this current crisis.

Retailers can take learnings from the Harvard Business Review's recession research to improve their current tactics even though the UK isn't officially in a recession yet.

Each of the above groups will require a different approach to marketing communications so understanding your target audience and which group they may sit within will be essential.

With this in mind, here is our advice on how to approach marketing campaigns targeting homeowners or home buyers during the cost of living crisis:

Sending the right offers

A survey from KPMG researching how consumers are planning to spend throughout 2022 showcased that people with savings were still planning on investing in:

- Home improvements (32%)

- Home appliances and electronics (21%)

- Buying a new home (19%)

While 28% stated that they weren't planning on making any 'big ticket' purchases this year, there are still 72% of consumers looking to invest in products you're likely selling.

With that said, consumers will generally be a bit more apprehensive about crossing that line and parting with their money, so planning specific offers at the right time will help them take that leap.

If we look at the general home moving timeline and use the in-depth, recent customer data collected by us at TwentyCi, you can plan in specific offers targeting homemovers. For example:

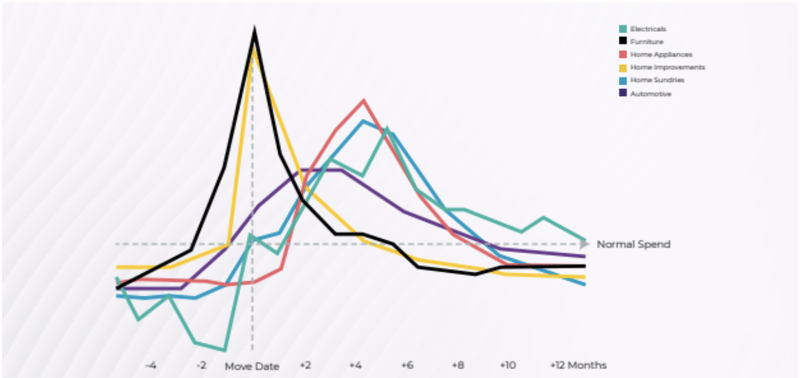

- Retailers can plan offers for electrical products to people four months after their move. These offers shouldn't be published in the two months leading up to a move, as shoppers are the least likely to invest in these at this time.

- Offers for home appliances will likely perform best when targeting people five months after a move.

- Retailers in the home improvements and furniture sectors should plan any offers as close to a move date as possible.

While consumers will still be willing to 'treat' themselves throughout the cost of living crisis, it's highly likely that you will see homeowners or people in the midst of a move investing in essential items in the short-term.

That is until we transition into the festive period. Over Christmas, there will likely be more of a shift back to those more indulgent purchases as consumers contemplate the gifts they will buy for others.

With all this in mind, you'll likely see a better response to your marketing strategy (both traditional and digital) if you plan your sale offerings to target 'essential products' in the short term and shift this to include 'treat products' as you get close to the Black Friday, Christmas and January sales periods.

By shifting your marketing budgets to promote products in these categories, your brand can reduce wasted spend and show your target audience and potential customers that you understand their current needs.

Timing your communications

During uncertain economic times, many brands respond by reducing or removing their marketing entirely. However, the Harvard Business Review states that businesses that 'take a scalpel' to their marketing budget rather than a 'cleaver', and task their marketing team with adjusting tactics and strategies are more likely to perform better during and after the economic downturn.

This viewpoint has been confirmed by the recent pandemic, whereby brands that strived to stay relevant and find additional ways to support consumers rather than stripping back on messaging and marketing budget entirely had greater success during recovery.

While we are yet to see the full impact of the cost of living crisis, the uncertain times over the last few years and even decades prove that maintaining communications is going to be vital for swift business recovery following this latest economic downturn.

It will likely take longer for customers to convert so timing your message in line with this shift will be important. You may need to focus more of your messaging on empathetic and inspirational content for longer, before moving on to communications that target making a sale.

Additionally, if you are planning any sales or offers, contemplate timing these in line with the average 'pay day' and target advertising your sale in the run-up. This way, customers who already know what they are planning to buy will be more likely to complete a purchase on their payday, when the price is better and they've had the opportunity previously to make their selection.

Using the most cost-effective channels

eCommerce marketing best practice recommends that you focus your campaign creation efforts on the channel you're looking to publish it on.

For example, you wouldn't usually use the exact copy you've created for a PR campaign for a social media advert as part of your digital marketing strategy.

In addition, you'd ideally allocate a specific budget to as many marketing platforms as you know your target customers are using.

But, to go back to the 'scalpel' approach the Harvard Business Review mentions, you could:

1) Temporarily plan campaigns that could work on numerous channels as a short-term solution

This approach is incredibly tricky to do as you will need to plan content and communication campaigns that have the flexibility to be used on multiple platforms while making it feel to your audience that it is meant to be there.

If a campaign running on social channels doesn't feel like it belongs there, you run the risk of alienating your audience and lowering your online visibility.

That doesn't mean it's impossible to be successful in this approach, but it may take some trial and error to get right. The timing of home moving expenditure will be vital here as you will need to have the messaging exact by the time of 'peak spending.'

For example, the peak for purchasing home furniture is during the actual move. This is a considerably small window and if the messaging hasn't been perfected, furniture retailers could miss the opportunity to make a sale.

The second option is much easier to achieve success with:

2) Reduce the number of platforms you target

In an ideal world, you'll want your brand to be visible everywhere your audience 'is'. However, throughout the cost of living crisis, it may be more financially viable to focus all of your marketing efforts on your most profitable channels.

It's important to review which channels are the highest performers for your brand and to research where your target customers are spending their spare time. You may need to strip back on some channels and invest in some new ones in the short term.

While there is no 'magic solution' for businesses to come out of the other side of the cost of living crisis, keeping your focus on your target customers, maintaining communication and planning the right time to execute campaigns via the best channels will be vital for retailers selling to customers in the process of buying a home or who have recently moved.

TwentyCi collects, supplies and analyses customer intelligence and consumer data specifically for retailers targeting home buyers and homeowners.

Our Property Data and Multi-Channel Marketing services could be essential to pivoting your marketing plans for increased chances of success. Get in touch for the most relevant data at your fingertips.