The Time to Progress on a Sale of Property in the UK is Now Shorter. What Does That Mean for Retailers?

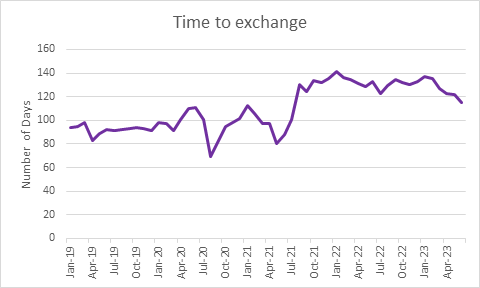

Since February, we have been observing with interest as the number of days it takes to progress on a house sale in the UK has been declining steadily. We measure the time to progress by the difference in days between the last sale agreed date and the sales process completion date. This drop is encouraging news for the property market and a positive sign for retailers targeting the home-moving audience.

What Caused High Time to Exchange Rates?

Our Strategic Solutions Director, Stuart Ducker stated, “Since the market got busy in 2021, we have seen the time to progress on a sale property in the UK, post getting a sale agreed, grow considerably and remain high.” The pandemic caused a huge spike in the housing market with those working from home seeking to relocate to more rural properties or upgrading to a home with office or garden space. The stamp duty holiday and historically low interest rates advanced things further with ‘For Sale’ signs popping up far and wide. However, with that surge in sales agreed came a backlog of work for busy conveyancers. Their increased workload had a knock-on effect on how long it has taken to complete the house-moving process. As a result, the time to progress significantly grew and has stayed that way. January 2022 saw it peak at a massive 141 days. Homemovers found themselves waiting for an agonising 4.6 months to progress from agreeing on the sale of their new property to exchange and moving into it.

“Since the market got busy in 2021, we have seen the time to exchange on a sale property in the UK, post getting a sale agreed, grow considerably and remain high.”– Stuart Ducker, Strategic Solutions Director

Changing Rates in 2023

Since the start of this year, the time to progress rate has finally started to drop. In February 2023 it was 136 days and it fell to just 115 days in June 2023. This is the lowest it has been since July 2021, so it’s a really promising sign. In fact, the total number has fallen by 17 days in the last year alone.

What does that mean for retailers and other industries?

The increasing pace of property transactions can stimulate market activity. This then has a ripple effect on industries such as the financial sector, retailers and new house builders. When the property market is more efficient, buyers and sellers are more confident, which leads to consumer spending, investment and economic growth.

With homemovers securing the keys to their new homes faster, they’ll be looking to purchase a range of products and services earlier. Let’s not forget the homemover is an extremely valuable customer who spends a remarkable £29 billion a year. When they’re moving into their homes quicker, they will be in the market for new bathrooms, new kitchens, home improvement goods, utilities and insurance services sooner. A wide range of industries should enjoy realising their sales earlier as the homemover progresses through that home-moving journey at a quicker pace than before.

Why is the Time to Exchange Rate Falling?

One of the main factors that is helping to reduce the time to exchange is the increase in the available supply of properties. We’ve seen a substantial rise in mid to high-priced properties on the market. Buyers now have a wider choice of properties to choose from. This means they’re more likely to find somewhere they like when they enter the Sold Subject to Contract stage (SSTC). When the supply of properties is low, buyers struggle to find a new home and it stalls the whole process.

Will the Trend Continue?

Although it is an encouraging development, we must remember that the average time to exchange was only 92 days in June 2019. At 115 days in June 2023, we are still a way off pre-pandemic rates. We will continue to monitor the figures in the coming months and are hopeful of a continuing downward trend.

Why work with TwentyCi?

TwentyCi is the number one provider of UK residential property data and marketing services We supply property data insights and residential property market analysis for estate agents, retailers, the financial sector and more. We know just how valuable home movers are and can help relevant companies to boost their sales by targeting those at various points of the home-moving journey. Our smart and price-effective marketing services, coupled with our data, analysis and experience can assist you with understanding the motives and intentions of homemovers and ultimately help you to unlock ways to reach new customers. If you’d like to find out more, get in touch with us today.