Non-movers: How can retailers target people frustrated by a fallen-through house sale?

“The only thing that moves quickly in the housing market is sentiment and it has been damaged over the last week as mortgage products have been pulled.”

When there’s turmoil in the property market retailers who target homeowners, homebuyers and homemovers feel the impact too. While there have always been successes and failures in the home-buying process, the recent Cost of Living Crisis, the war between Russia and Ukraine, as well as upheaval in our own governments and more have resulted in a rise in non-movers.

Who is a non-mover?

A non-mover refers to someone who begins purchasing a property but for some reason ends up not making the purchase. Common reasons for this include:

- Mortgage offers being revoked,

- Changes of circumstances or heart,

- Property surveys highlighting considerable issues,

- Breakdowns in the chain,

- Gazundering, or

- Gazumping.

The recent disruption has mainly impacted mortgage offers, with more being pulled or rejected than what is considered to be normal.

The good news is that the housing market is expected to improve and become steadier in future, which will result in more trust from lenders and lowered risk-averse behaviour.

The slightly less good news is that this balance is expected to be slow:

“The expectation in the industry now is that the picture is likely to improve for mortgage borrowers from the current situation, but slowly.”

So while there is certainly hope on the horizon for retailers, there will likely continue to be a dip in sales as non-movers have to begin their process again or push back their timelines to buy entirely.

We all know the substantial spending that comes with a house move, so what can brands like yours do to remain profitable and continue to connect with a target audience that is likely incredibly frustrated?

What skills marketers need to market to ‘non-movers’

One of the most important skill sets marketers who operate in the home eCommerce sector require is the ability to pivot strategies to ensure a continuous flow of revenue and profit. This requires in-depth knowledge of the different stages homebuyers are at and the budgets at their disposal.

Another vital skill set is the ability to communicate with shoppers in the way they want to be communicated to. Non-movers are likely to be frustrated, so an empathetic approach will be key to maintaining your relationships with your audience.

Here’s what you can do to ensure you stay connected with potential shoppers until they are ready to invest (when they have secured another home and mortgage), and how you can pivot your approach to remain profitable:

Reduce marketing spend on targeting first-time home buyers

This advice may change, but at the time of publishing news reports were suggesting that first-time buyers are going to struggle the most to obtain a mortgage. If you have specific marketing campaigns targeting first-time homemovers, it may be worth temporarily reducing conversion-led marketing campaigns and focusing more on hope and excitement-filled campaigns to keep spirits high amidst upheaval.

Seeing conversion-led advertisements, whether traditional or digital, targeting first-time buyers may appear insensitive or portray that you aren’t aware of the challenges your customers are facing. A constant reminder of a considerable block to buying their first property will disappoint shoppers, discouraging them from interacting with you.

With that said, it’s still important to build and maintain these relationships, but not so much through conversion-led advertising until mortgage approval rates for first-time buyers improve. Relationship-building campaigns may be the best option for the moment.

Focus on marketing to audiences looking to increase their property value

A recent survey has shown that 69% of house sales complete without issue, 21% reported that their property sale has fallen through once, 7% experienced their property sale falling through twice and 3% more than three times.

In addition, the same survey found that a property sale falling through could delay a move by:

- 0-3 months - 38%

- 4-6 months - 22%

- 7-9 months - 10%

- 10-12 months - 4%

- 12+ months - 10%

- No move took place at all - 16%

So, that means that, while there is still a good market of home-movers progressing their sale without issue, there are 31% of your target audience who are stalled in the process and could be for quite some time.

During this period, many will compromise on the price of their property to try and increase the speed at which they can sell their property and move to their new residence. Others will look to carry out home renovations to increase their asking price.

This audience is a perfect market for home improvement retailers.

Source: GetAgent.co.uk

Source: GetAgent.co.uk

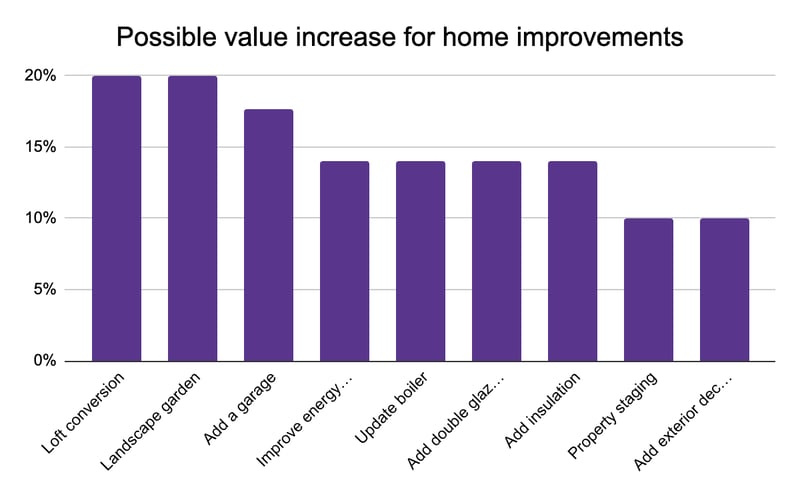

Above are the types of home renovations that have the potential to increase a possible asking price the most. Some home renovation projects are more costly than others, with the most expensive being:

|

Project |

Average Cost |

Value Added |

|---|---|---|

|

Loft conversion |

£36,500 |

20% |

|

Add a garage |

£21,000 |

17.67% |

|

Kitchen remodel |

£8,000 |

4% |

|

Add a conservatory |

£5,000-£7,500 |

5%-7% |

|

Bathroom remodel |

£3,000 |

4% |

|

Add exterior decking |

£2,200 |

10% |

|

Landscape garden |

£1,200 |

20% |

|

Redecorate |

£1,000-£3,000 |

5% |

|

Update boiler |

£1,000-£3,000 |

14% |

|

Paint property exterior |

£1,000 |

2% |

Luxury staging

The same survey mentioned above noted that home staging can add approximately 10% to the asking price a homeowner can request, and 75% of surveyed estate agents agree that staging can increase the offer value.

This is a great opportunity for retailers who usually target audiences in the run-up to a move and in the months following a move. By pivoting some of your marketing efforts to targeting people contemplating staging their homes, and helping them choose the right furniture, artwork or accessories, retailers can help fill the profit gap while there’s turmoil in the markets.

Focus on people staying put

Finally, as mentioned earlier, 16% of non-movers decided not to move at all. Whether your brand sells home improvement products or home furniture and accessories, here is another opportunity to shift your focus and remain profitable while the housing market balances.

By focusing your marketing messaging on updating your audience’s ‘house’ to make it a ‘home’ and similar, you can convince them to reallocate some of the money they saved towards moving to update their home instead. They may be more inclined to invest in more luxury products or invest in less expensive products to buy more. With this in mind, it’s worth focusing on a range of price points to increase your profits as much as possible.

This may also be a fantastic opportunity to invest in cross-selling and upselling techniques to increase profit on a lower budget.

How TwentyCi’s data can help

The home moving process is a long-winded one, with spending budgets drastically changing at different stages of the buying and selling process. The correct timing of a retail marketing campaign can drastically impact performance, revenue and profit.

This is where TwentyCi can help.

Our Multi-Channel-Marketing service uses data to ensure precise targeting on the strongest channels for retailers.

Our Homemover Data can provide an in-depth understanding of your target audience, and what is influencing their behaviour, and use this information to increase campaign performance and sales.

TwentyCi has been gathering data to support retailers for more than a decade. With the UK’s largest and most sophisticated homemover database, we can help you drive sales and better serve your target customers.

While news stories may currently be painting a bleak picture and there are indeed challenges, the property market remains robust and by pivoting your approach, your retail brand can still remain profitable.

Sources:

- https://www.getagent.co.uk/blog/selling-tips/house-sale-falls-through

- https://www.getagent.co.uk/guide/selling-your-house/how-to-add-value-to-your-home

- https://www.homesellingexpert.co.uk/guides/what-percentage-of-house-sales-fall-through